Recent searches

Search options

It’s possible that #Trump is trying to cause an economic downturn to lower borrowing costs in the end. After all, he has been expressing aggravation with the Fed chair for not lowering interest rates further. It’s quite twisted and makes no sense because a lot of his ideas are pro-inflationary, but it’s possible.

~ 10-year Treasury yields are falling. Want the good news first? ~

https://www.marketplace.org/2025/03/05/10-year-treasury-yields-are-falling-want-the-good-news-first/

/2

A Yahoo Finance commentator said that #Trump is trying to cause a recession to lower the 10-year yield. While I wouldn’t go quite *that* far yet — after all, he *may* want his party to get elected again (?) — he definitely wants to lower borrowing costs to spur economic growth.

#USA #USeconomy #economics #finance #USPol

~ Trump wants lower yields on 10-year bonds. Can he make that happen? ~

https://www.marketplace.org/2025/02/06/trump-administration-10-year-bond-yield/

/3

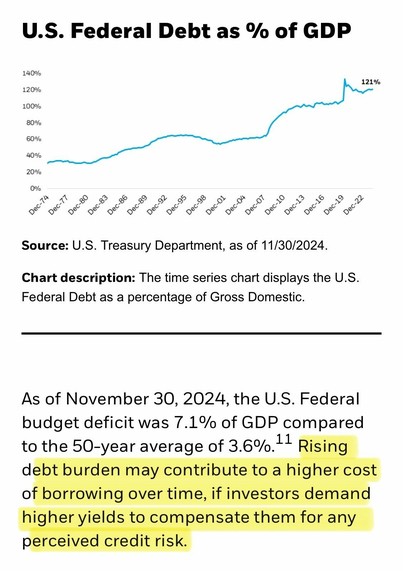

A prudent way to lower the 10-year yield is to lower (or eliminate) the nation’s budget #deficit (and its need to borrow to cover the subsequent #debt.)

The #USA must correct its budget deficit in the long-term. But massive tax cuts will not accomplish that goal. Even considering the “savings” the admin is attempting to find.

/4

Okay, so after digging into it further, it seems the current US Treasury Secretary, Scott Bessent, has been touting the #Trump admin’s plan to single-handedly lower the 10-year yield for quite a bit now.

To accomplish this feat, Bessent said Trump wants to “deregulate the economy…get this tax bill done… get energy down.”

#USA #USeconomy #economics #finance

~ Bessent's focus on 10-year US Treasury yield may let Fed off the hook ~

(from Feb 6, 2025)

Sigh… it’s the same stuff that didn’t work in the past (several different times).