Recent searches

Search options

I have, much to my dismay, learned enough about stock trading to explain how to bet against Tesla as an individual, with your own money. Doing this can put downward pressure on Tesla’s stock price and hurt the company. (And if, like me, you’re betting that Tesla is grossly overvalued and #TeslaTakedown will hit it hard, then this might actually make you money — but don’t count on that!)

I’ll share what I’ve learned in a thread here. I hope it helps others, and I hope people with actual expertise will correct me if I say anything wrong.

1/

Here’s the brief version:

- You can buy something called an “inverse ETF” to bet against a company.

- You can lose this way, but not more money than you put in.

- The inverse ETFs for Tesla are TSLS, TSLQ, and TSLZ.

- Holding on to them hurts Tesla.

- To buy them, you need a brokerage account, and it needs to let you buy inverse ETFs.

- Anyone can open a brokerage account. It’s a nuisance and it takes 3+ days, but it’s ~free.

And:

- A large number of people doing this each with a small amount of money would have a real effect on Tesla.

2/

Like me, you’ve probably heard of shorting stock as a way of betting against a company. Everything I’ve learned about this says: DON’T. This is like learning to snowboard by doing jumps off a rocky cliff. You will hurt yourself badly.

The details are complicated, but the short of it (pun intended) is that you can actually lose •more• money than you put in. And there’s no limit to how much shorting can put you in debt. Don’t.

Especially don’t if you’re extra smart, because you’ll just figure out how to hurt yourself worse.

3/

Fortunately, there’s this thing called an “inverse ETF” that lets you bet against a company without that risk. Again, details are ridiculously complicated, but basically it acts like a normal stock that moves in opposite proportion to some other stock.

The important thing here is that is puts downward price pressure on a stock — i.e. it hurts that company’s investors — without the possibility of you losing more money than you put in.

Inverse ETFs for Tesla are TSLZ, TSLQ, and TSLS.

4/

Inverse ETFs are not a good investment choice unless you really, really believe than a company’s stock price is going to go down. And investment guides tell you that you shouldn’t normally hold them for more than a very short period.

AFAICT, that’s because •running• an inverse ETF is costly, and the people who run them past those costs on to inverstors. So they tend to lose money long term unless the stock •keeps• going down and down and down and down.

But if you actually think a stock is going to do that, well….

5/

If you think Musk is bad news, if you want to bet against Tesla, and if you have a little money to do that, here’s the tactic:

- Buy TSLQ, TSLZ, and/or TSLS.

- Do •not• put in more money than you’re willing to lose. Expect that you’re kissing your money good-bye when you buy those ETFs. If your bet pays off, lucky you! But don’t spend your life savings on this, for heaven’s sake.

- Hold, hold, hold until Musk is completely kicked out of either Tesla or the government.

6/

If like me you need to open a brokerage account, Fidelity or Charles Schwab seem like credible choices. (Steer clear of Robinhood and most other investment apps.)

If you already have a retirement account, you might be able to open an brokerage account there too and save yourself minor hassle — but make sure they actually like you buy inverse ETFs (TIAA does not, for example).

If you have a SEP-IRA, it may let you trade inverse ETFs without needing a separate brokerage account (but see warning above about not betting money you can’t afford to lose).

7/

If you open a brokerage account, expect minor hassle spread over 3+ days. You have to fill out forms online, verify your bank account, transfer money in, yada yada. They walk you through the process. Just expect lots of waiting.

I personally do not trust the thing where you log into your bank account through the brokerage’s web site. Yikes. I used direct deposts to verify my account, which took 3 days but feels like a lot less of a security YIKES to me.

8/

Once you have your brokerage account:

- Transfer that small “I’m willing to lose this much” amount into your brokerage account

- Buy TSLZ, TSLQ, and TSLS.

- Hold on to it. Don’t even pay attention to it going up and down unless you’re a glutton for punishment.

- (And maybe just do •not• do any of this if you know you have a gambling addiction. You will be tempted to put in more than you should.)

9/

I put in just a few hundred dollars, an amount I’m wiling to sacrifice. I think Tesla’s in deep shit and this might actually make money, but it’s a moonshot.

Regardless of whether I personally make money, this signals to the market that I think Tesla is overvalued and likely in serious trouble. That hurts Musk, whose power and wealth is directly tied up in the huge amount of Tesla stock he owns — and in people believing he’s some kind of magical golden child who will turn Tesla into a money unicorn with his galaxy brain.

10/

And yes, Tesla investors are gradually starting to understand that maybe Musk is trouble. Like the poor schmuck in this article:

❝Ives said Musk needed to announce formally that he was going to balance running Doge with being Tesla’s chief executive. Doing so would “dissipate” the heat around Tesla and avoid permanent brand damage, although there would still be a “scar”, he said. “Investors need to see Musk take a step back and balance his Doge and Tesla CEO roles,” Ives said.❞

“Formally announce…balance…dissipate….” Oh, poor spring child, you are just beginning to dimly compherend the hot water you are in.

11/

In my ignorance, it seems like a large number of people buying a small amounts of these inverse ETFs really could make a difference.

The inverse ETFs •do• actually drive down the stock price, AIUI: more shares of the inverse ETFs → more Tesla stock shorted → price of Tesla driven down. That directly takes money from Musk’s pockets. And it makes Tesla stock riskier and risker for the big funds who’ve been buying it as a supposedly safe bet.

12/

So, if you want to help, if you have time and a little money and are interested but daunted…well, ask questions! I’m no expert, but I’m happy to talk about my own experience, and hopefully others here can help too.

/end

Several replies also mention options trading, such as this from @JessTheUnstill, as a way to manage your bet against Tesla more closely:

https://infosec.exchange/@JessTheUnstill/114196064404618244

AFAICT, this is a great thing if you have time and mental energy to devote for this and are a glutton for learning and micromanagement. Like…if you’re the sort of person who regularly tries out new Linux distros just for the hell of it, this might be for you!

If (like me) you want to go through the setup process once and then let the money do the work for you, the inverse ETFs seem like the way to go.

After this thread, I just feel like I should say:

- Please don’t go overboard. This is direct action, and symbolic, and a moonshot — not a Sensible Investment.

- Please do not become a day trader because of me. It’s a fool’s game. If you’re fortunate enough to have some retirement money, put it in mutual funds. If you have money to invest, get an investment advisor. Please don’t let a brokerage account you created to punch Musk become a gateway drug for you to lose your money gambling on stocks! I’d feel very bad.

@inthehands Responsibly, I decided to add just $100.00 more of TSLZ and TSLQ to my portfolio, just to keep the scent of impending brand-death fresh...

@jab01701mid

OK…as long as it is responsible! I think there will be a temptation to just keep trickling more and more money into this, past the point of acceptable loss. As long as we are all clear about where our personal limit is….

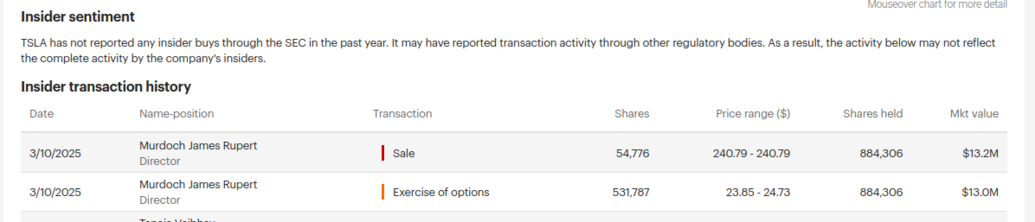

@inthehands Did not realize Rupert Murdoch is on the Tesla board, just exercised and sold $13M worth of options a few days ago.

Edited to note this is "James Rupert Jacob Murdoch, born 13 December 1972 (age 52)", not senior.

h/t @MaryAustinBooks

@jab01701mid @inthehands

James Murdoch, Rupert's relatively left leaning and hence estranged son